PART II

In Part I, we argued that meeting the ambitious targets agreed upon at the 21st United Nations Framework Convention on Climate Change (UNFCCC) Conference of the Parties (COP21) will require concerted efforts—including policy changes, technological developments, the deepening of financial markets, and political leadership. Developments will be more fruitful if they are marked by collaboration between two of the world’s largest economies and heaviest energy consumers–China and India. In Part II, we detail our discussion on renewable energy and climate finance.

Renewable Energy

In China and India, some of the fastest and most apparent green growth is occurring in the field of renewable energy. In both countries, electricity generation from renewables is surging under strong government support. Both countries agree that renewables represent a path toward sustainability while satisfying energy demand and providing access to remote regions. As domestic resources, they also enhance Chinese and Indian energy security. China recently increased its renewable energy targets to 150-200 GW of solar power and 250 GW of wind power, each to be achieved by the year 2020.[1] In 2014, the country invested more than $90 billion in renewable energy.[2] India has also made considerable progress building up its renewable portfolio. In 2000, non-hydro renewables represented only 2 percent of India’s power generation, but they stand at 13 percent today.

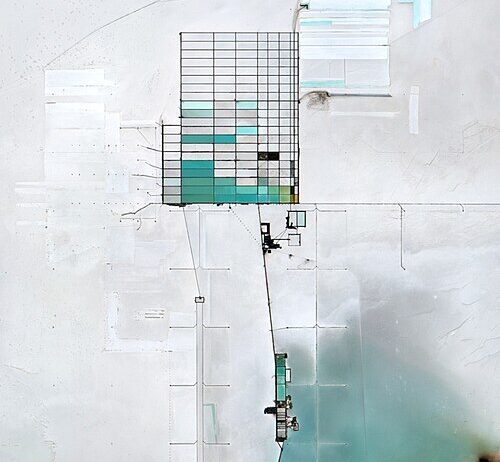

The dramatic growth in China and India’s renewable energy sectors is nonetheless limited by several factors, including energy market structure, lack of financing options, and technological barriers. For example, while government financial support and Independent Power Purchaser (IPP) involvement has enabled large growth in utility-scale wind and solar power plants in Western Chinese provinces like Xinjiang and Gansu, around 30%-50% of that electricity production has been curtailed due to several reasons: 1) weak local demand in the western part of China; 2) lack of grid interconnection to higher demand centers; 3) grid construction that can’t keep pace with the construction of renewable energy plants; and 4) occasional grid stress caused by turbines producing power levels that exceed demand.[3]

As for India, Modi’s mission to “electrify India” through renewables is expected to face considerable challenges. Critics argue that a 266 GW goal of additional renewable capacity is not feasible, given that the subcontinent’s total installed capacity stands at 250 GW combined.[4] Reaching this ambitious goal may be hindered by grid integration challenges. For example, the grid in its current state can only handle up to 20-30 percent renewables in its power mix, and increasing capacity beyond this point would require costly upgrades to India’s transmission infrastructure, either through better grid management or more peak plants. However, performing the upgrades that are necessary to integrate large amounts of intermittent renewables into the grid system may fall behind the priority of providing universal energy access.

While many of these challenges are country-specific and must be dealt with at the domestic level, some renewable energy challenges are universal. In both China and India, wind and solar photovoltaic (PV) suffer from grid connectivity issues, equipment quality problems, lack of interconnections between provinces, and other factors. Subsequently, breakthroughs in the efficiency and affordability of power saving technology, as well as grid management strategies, will be critical to the widespread adoption of alternative energy. China and India would see many benefits from collaborating on renewable energy production, particularly in wind and solar power.

In particular, the two countries should aim to collaborate on renewable development through joint business ventures, knowledge-sharing, joint RD&D projects, and increased trade opportunities.

Engage in knowledge-sharing and joint RD&D

There are several opportunities for collaborative low-carbon development. On a bilateral basis, China and India should engage in knowledge and best-practice sharing regarding technology, policies, and regulations. In this sense, education exchange programs and industry partnerships may be useful ways to encourage dialogue between scientists, engineers, and business people. Current programs exist to facilitate discussions on climate change within the countries, such as the Mission on Strategic Knowledge on Climate Change (MSKCC), part of India’s National Plan on Climate Change. Similar bodies could potentially be formed to create opportunities for Indian and Chinese researchers to collaborate on renewable development.

Furthermore, because the low carbon development field relies on technological integration and incremental advances, it is particularly well suited to joint RD&D. China and India should engage in both bilateral and international RD&D efforts, conducting assessments on existing technological capacities and market structures to combat their shared renewable integration challenges. For example, as China and India collaborate in upgrading their existing grids to reduce transmission loss and enhance renewable integration, the two can initiate best practice sharing with developed countries, like the United States to augment their collective knowledge.

Lower trade and investment barriers

On May 14, 2015, President Modi arrived in China for a three-day visit, during which he met with a handful of Chinese businesses and announced $22 billion worth of bilateral business deals, signify a strengthening in commercial ties between the two Asian neighbors.[5] Many of these company collaborations represent avenues of increasing levels of investment and trade between China and India. For example, the Adani Group plans to set up an integrated photovoltaic (PV) industrial park in the Mundra special economic zone (SEZ) in a joint venture with Chinese green energy major Golden Concord Holdings, a deal worth upwards to $3 billion.[6]

To continue this trend of economic and trade collaboration between India and China, both governments should look at reducing trade barriers of low-carbon goods and technology. As indicated in a 2007 World Bank study, the potential for liberalization in the area of low-carbon goods could lead to real increase in trade flows.[7] Existing barriers such as complicated applications and approval procedures, sector-based limits on FDI, and anti-dumping import bans issued by India against China should be reduced or eliminated.[8] In addition, China and India could alleviate low carbon trade barriers by liberalizing their cross-border procurement rules. For example, many state-funded projects in China currently require that 80 percent of technologies be sourced domestically.[9] Expanding this preferential treatment to Indian firms (and vice a versa) could help to build an efficient and integrated market.

Climate Finance

Securing adequate financial resources will be the key enabling factor for most low-carbon initiatives. Significant progress is starting to be made in this area. For example, in 2015, China announced a new climate finance commitment of around $3.1 billion to help developing countries combat climate change.[10] During President Modi’s visit to China in May, the two sides urged developed countries to honor their commitment in providing to developing countries $100 billion annually by 2020.[11] Despite these pledges, though, there still remains a lack of financing mechanisms to help China and India overcome the high cost of implementing their “green” targets. China has estimated that two-thirds of the country’s total green investment needs, about $320 billion annually, will need to come from private capital markets to alleviate the burden of fiscal pressure.[12]

Both China and India stand to benefit greatly from introducing climate-oriented financial policies, as it would allow both countries to signal their resolve on low-carbon development and even become leaders of the global movement toward green finance. Recent efforts to introduce sustainable finance in China and India reveal that both countries already recognize the potential benefits of green financial innovation. This is evidenced by the China Banking Regulatory Commission’s (CBRC) passage of green credit guidelines in 2012 and YES Bank’s work to pioneer green bonds in India earlier this year.[13] The following outlines several promising areas of collaboration between the two countries and serves as a useful starting point for future dialogue on these issues.

Green Credit Guidelines

As a first step toward market integration, India and China should strive to introduce and implement effective green lending standards that assess projects on the basis of their environmental and climate impacts. These guidelines would serve as a reference for banks to direct funds to environmentally responsible projects, while increasing transparency and attracting international investors.

The People’s Bank of China has already taken steps in this direction through the introduction of the Green Credit Guidelines in 2012, and through its advocacy for green lending principles in overseas investment.[14] China’s recent experience can help to inform a joint dialogue between China and India on institutionalizing such green credit guidelines at the international level. This could entail working with the Asian Infrastructure Investment Bank (AIIB) or other multilateral development banks to adopt the Equator Principles and associated green credit guidelines for their own lending programs.

Corporate Green Bonds

Green bonds offer another promising option for financing the shift to low-carbon development in China and India, as they are well suited to long-term infrastructure projects that require high upfront capital costs.[15] Although Multilateral Development Banks have been the primary issuers of green bonds since their launch in 2008, the market is experiencing rapid growth due to the increased participation of government agencies, municipalities, utilities, and corporations.[16] Standard & Poor’s has estimated that corporate and municipal issuances of green bonds will drive even greater growth in global green bond markets in the future, with the potential of corporate green bond issuance to reach up to $30 billion in 2015, a 50% increase from 2014.[17]

China and India could develop a robust corporate green bond market in Asia by jointly developing a series of policies for their two countries that can serve as a model for financial innovation elsewhere. Establishing a robust green bond market would require developing standards for green project certification (e.g., based on the Green Bond Principles), introducing strong auditing procedures (e.g., through a third party regulator), and developing financial incentives to stimulate the domestic green bond market (e.g., tax exemptions, adjusted loan-deposit ratios and risk weightings for green investments).

Green bonds offer China and India a key opportunity to leverage private sector resources to finance sustainable infrastructure, while lowering the cost of financing for green projects and improving the depth and maturity of domestic fixed-income markets. Furthermore, both China and India would gain substantial international prestige for establishing the world’s first corporate bond markets in the area of green financing, even becoming centers for corporate innovation in climate finance.

Joint Infrastructure Debt Fund

Along with efforts to expand green bond markets in Asia, policymakers in India and China should consider establishing a joint infrastructure debt fund (IDF) exclusively for low-carbon development projects. This infrastructure debt fund would operate like a mutual fund by raising money from investors and channeling the proceeds into green bonds issued by companies and projects. This would support each country’s nascent corporate green bond market by providing a dedicated source of funds, while lowering the cost of financing by injecting much-needed liquidity into the corporate green bond sector. According to the Climate Policy Initiative, this could decrease the cost of debt of renewable energy projects in India by up to three percentage points and increase loan tenors by up to five years.[18]

China and India could establish a joint IDF for green projects at the bilateral or multilateral level. Considering its focus on infrastructure, the AIIB would be an ideal setting to launch the IDF, especially if it becomes a forum for developing green investment policies in Asia. A joint IDF, as opposed to separate national IDFs, would be uniquely positioned to diversify its assets by investing in a number of different green projects in China, India, and other countries if established at the multilateral level.

Risk Mitigation

Another promising topic of collaboration on green finance between India and China is in the area of partial credit guarantees for green projects. The purpose of partial credit guarantees is to lower the cost of financing for long-term projects by covering some or all of the associated risks of these projects and thereby enhancing their credit ratings. Partial credit guarantees could be especially useful in India, as they would allow institutional investors to invest in corporate bonds that are currently too risky to attract investment.[19]

Given the potential of such guarantees to raise investment in long-term infrastructure projects, China and India could lobby for the development of a “green” partial credit guarantee mechanism to be launched within the AIIB, New Development Bank, or another multilateral setting. Since one of the major challenges of setting up such guarantees is the complex coordination required between lenders, guarantors, and project developers, the benefit of establishing the partial credit guarantee mechanism at the multilateral level is gaining access to resources and expertise to organize such complex arrangements.

The above recommendations provide some of the most promising ways in which China and India can collaborate to establish a common framework for green investments in Asia. The huge scale of investment required in sustainable infrastructure in each country, as well as the importance of achieving a global consensus on low-carbon development, ensures that their collaboration on these issues will be essential in expanding green investment opportunities across the globe.

For a downloadable copy of the full report, please click here.

[1] “The Road to a Paris Deal / China Raises Its Targets for Renewable Energy,” New York Times, December 8, 2015, http://www.nytimes.com/interactive/projects/cp/climate/2015-paris-climate-talks/china-raises-its-targets-for-renewable-energy .

[2] Liu Yuanyuan, “China’s Investment in Renewable Energy Surpasses Europe, U.S. Combined,” Renewable Energy World, November 25, 2015, http://www.renewableenergyworld.com/articles/2015/11/china-s-investment-in-renewable-energy-surpasses-europe-u-s-combined.html.

[3] “Great Western Province, the New Energy Projects Abandoned Electricity up to Five Percent,” Economic Information Daily, August 1, 2013, http://jjckb.xinhuanet.com/2013-08/01/content_458890.htm.

[4] Katherine Tweed, “India’s Lack of Wholesale Markets and Grid Investment Could Hinder Ambitious Renewables Commitments,” Green Tech Media, March 4, 2015, http://www.greentechmedia.com/articles/read/Overly-Ambitious-Renewable-Commitments-in-India-Lack-Wholesale-Markets-and.

[5] James Areddy, “India, China Businesses Agree on $22 Billion Worth of Deals,” Wall Street Journal, May 16 2015, http://www.wsj.com/articles/india-china-businesses-agree-on-22-billion-worth-of-deals-1431763185.

[6] Arun Kumar, “Deals Worth $23.5 Billion Likely to Be Signed during PM Modi’s China visit,” The Economic Times, May 15, 2015, http://articles.economictimes.indiatimes.com/2015-05-15/news/62192098_1_china-development-bank-adani-group-bharti-airtel.

[7] “Climate Change and Trade on the Road to Copenhagen,” International Centre for Trade and Sustainable Development (ICTSD), December 2008, Page 28; and “International Trade and Climate Change,” World Bank, 2007.

[8] Dhiraj Nayyar, “India and China Should Let Trade do the Talking,” Bloomberg View, September 15, 2014, http://www.bloombergview.com/articles/2014-09-15/india-and-china-should-let-trade-do-the-talking.

[9] The Energy and Resources Institute (TERI), National Centre for Climate Change Strategy and International Cooperation (NCSC), Central University of Finance and Economics (CUFE), Zhejiang University (ZU) and the United Nations Development Programme (UNDP), “Low Carbon Development in China and India: Issues and Strategies (Advance Publication),” 2014, Study by To be published by TERI Press, http://www.teriin.org/pdf/TERI-NCSC-CUFE-ZU_China-India-LCD-book.pdf.

[10] “Fact Sheet: The United States and China Issue Joint Presidential Statement on Climate Change with New Domestic Policy Commitments and a Common Vision for an Ambitious Global Climate Agreement in Paris,” The White House Office of Press Secretary, September 25, 2015, https://www.whitehouse.gov/the-press-office/2015/09/25/fact-sheet-united-states-and-china-issue-joint-presidential-statement.

[11] “India, China Commit to Work Together on Climate Change,” Reuters, May 15, 2015, http://www.reuters.com/article/2015/05/15/india-china-climate-idUSL3N0Y63YQ20150515.

[12] Zhang Chenghui, et al., “Greening China’s Financial System: Synthesis Report,” International Institute for Sustainable Development, March 2015, https://www.iisd.org/media/green-finance-growing-focus-china.

[13] “YES Bank Floats First Green Infra Bond for Rs 500 Crore,” The Times of India, February 17, 2015, http://timesofindia.indiatimes.com/business/india-business/YES-Bank-floats-first-green-infra-bond-for-Rs-500cr/articleshow/46269428.cms.

[14] “Establishing China’s Green Financial System,” The People’s Bank of China and UNEP, April 2015, http://www.unep.org/newscentre/default.aspx?DocumentID=26802&ArticleID=34981, 9. 18.

[15] Sean Kidney, “Greening China’s Financial Markets,” International Institute for Sustainable Development, February 2014, http://www.iisd.org/pdf/2014/growing_green_bonds_en.pdf, 6.

[16] “Green Bonds Attract Private Sector Climate Finance,” World Bank, June 10, 2015, http://www.worldbank.org/en/topic/climatechange/brief/green-bonds-climate-finance.

[17] Michael Wilkins, “Corporate Bond Market Shows it Green Shoots,” Standard & Poor’s Ratings Services, 2.

[18] Gireesh Shrimali, Charith Konda and Sandhya Srinivasan, “Solving India’s Renewable Energy Financing Challenge: Instruments to Provide Low-cost, Long-term Debt,” Climate Policy Initiative and Bharti Institute of Public Policy, April 21, 2014, 6; http://climatepolicyinitiative.org/publication/solving-indias-renewable-energy-financing-challenge-instruments-to-provide-low-cost-long-term-debt/.

[19] Ibid., 8.