Introduction

The 2021 National Security Commission on Artificial Intelligence identified artificial intelligence (AI) as an inspiring technology, one that will be the most powerful tool for future generations towards benefiting humanity.[1] It also recognized that AI-enhanced capabilities will serve as the tools of first resort in a new era of conflict and cooperation. Semiconductors, the driving force behind all AI algorithms, play a critical role in this new world order, especially when it comes to the competition between the United States and China, as the two powers engage in a struggle for dominance in AI and related fields. While the United States has historically enjoyed significant privileges in the realms of semiconductor manufacturing, production, distribution, and innovation, the People’s Republic of China has recently bolstered their domestic processes. Increased Chinese competition in domestic semiconductor manufacturing, accompanied by recent global supply chain issues in the past year, have highlighted the need for the United States to re-examine its domestic semiconductor processes. This paper will analyze the semiconductor manufacturing process, to assess the risks and benefits of current semiconductor processes in the face of Chinese competition. Additionally, it will examine domestic Chinese production and evaluate the criticalness of the United States returning some of these semiconductor processes back stateside to avoid supply chain and security issues, in order for US dominance to continue in information flows and AI.

How are Semiconductors Produced?

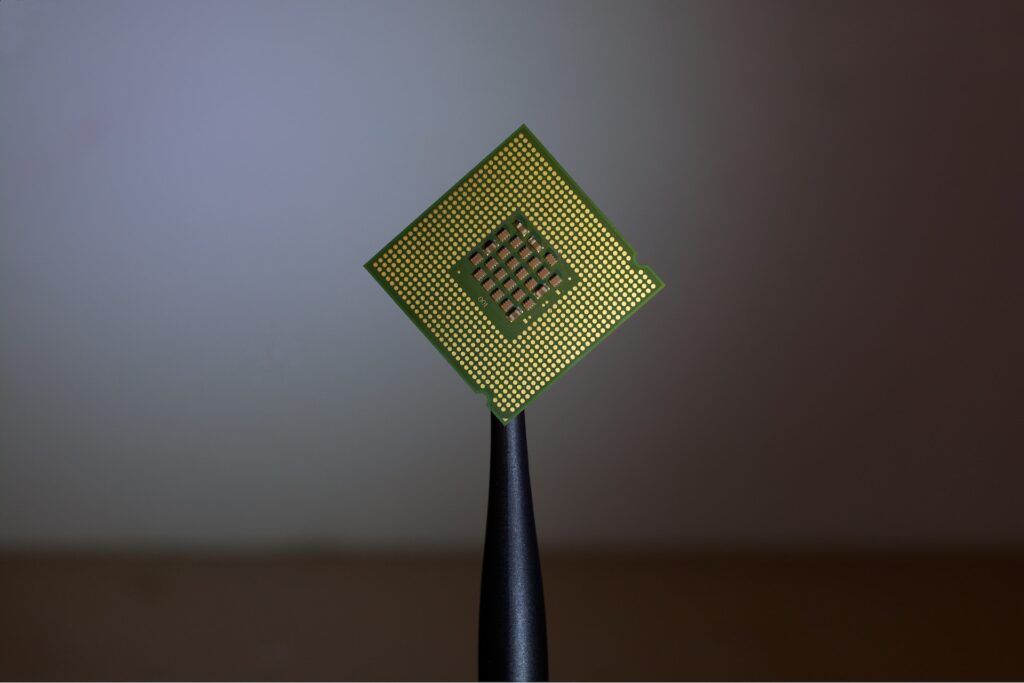

To understand the implications of the semiconductor reinvestment process, it is critical to outline how the production process works. Semiconductor production can be broken down into three phases: design, manufacturing, and assembly.[2] The design phase is characterized by the development of chip architecture, meaning engineers map out the electronic circuit patterns based on power; functionality; speed, etc.[3] The United States’ comparative advantage lies in the design and software phase in the semiconductor process. US design companies like Qualcomm, Nvidia, Broadcom, and Advanced Mico Designs control 68 percent of the market share for chip design.[4] In recent years, the design phase of semiconductor production has become increasingly essential, as semiconductors have grown smaller in size and have been incorporated into many consumer goods and services.[5]

The second phase of semiconductor production is manufacturing, where creation of the physical wafer occurs. Manufacturing sophisticated semiconductor wafers is an incredibly complex process. First, silicon crystals provide the raw material utilized to create semiconductors. Subsequently, these crystals are sliced into wafers, which become the backbone of the semiconductor. After the wafers are sliced, they are etched in various ways to allow for pathways for electrons to flow. This flow of electrons produces the finalized semiconductor.[6] At every phase of manufacturing, deep knowledge of design is required to avoid costly mistakes, especially as semiconductors become smaller and more complex.[7],[8] Furthermore, Semiconductors Fabrication Plants (FAB), which are locations in which semiconductors are manufactured, cannot be built easily because they require highly specialized knowledge and capital.[9]

Finally, the last stage—assembly (testing and packaging)—requires the least knowledge of the semiconductor process.[10] Assembly simply comes after the manufacturing stage is complete and the semiconductor is ready for final sale. Therefore, design and manufacturing are much more critical components of the semiconductor process. These two stages account for 45 percent of the final chip value and require the most capital and technologically-intense components of the semiconductor process.[11]

The Chinese Semiconductor Industry

To understand what security issues the United States faces in this realm, it is vital to examine the Chinese semiconductor industry. Currently, compared to strategies usually utilized by the United States, China primarily mobilizes resources, creates plans and strategies, and reaches its goals through governmental coordination and setting out specific objectives. China also primarily relies on planning, visualizing problems, and generates strategies accordingly. Furthermore, China focuses on identifying relevant actors, steering resources, and unifying all the bits and pieces essential to ensuring all phases are carried out successfully. Additionally, China’s private sector is also highly competitive, with businesses excelling in gaining large amounts of data to help them make gradual improvements in their business processes. Data is critical in an age defined by information flows, and the amount of data obtained by Chinese companies, combined with the Chinese government’s strong planning skills, strongly plays into their advantage.

On the other hand, China possesses several major weaknesses in their semiconductor processes. The first is an inability to allocate funds efficiently and strategically.[12] Even though China’s investment in developing a domestically viable semiconductor industry already totals to hundreds of billions of dollars, the final quantity of that capital has been smaller than advertised. Additionally, funds have not been efficiently allocated, especially at the provincial and municipal levels, and are frequently not sustained at the levels needed to support technological breakthroughs over time.[13]

The second factor is an inability to cultivate and retain human capital.[14] Chinese semiconductor firms struggled to be commercially viable until recently, so Chinese engineering professionals would study/work abroad or seek employment with foreign firms with Chinese facilities. These knowledge spillovers are essential to China’s semiconductor industry strategy and take the form of learning by doing.[15] With that said, they are contingent upon human capital that is capable of understanding and utilizing these spillovers. Without a substantial amount of skilled personnel, China will be unable to properly take advantage of knowledge spillovers. This is particularly important to the design phase of semiconductor manufacturing.

US export controls offer a third obstacle. The United States has imposed controls on exports to China related to semiconductors and semiconductor manufacturing equipment in various forms since the Cold War.[16] In recent years, export control policy in the semiconductor sector played a central role in Donald Trump’s tech war against China, with the US Department of Commerce adding China’s top chipmakers Huawei and the Semiconductor Manufacturing International Corporation to its “entity list” of trade restrictions in 2019 and 2020.[17]

The US Semiconductor Industry

Most of the chokepoint threats to the United States arise during the manufacturing phase of semiconductor production. Chokepoints are inputs, products, or processes that are essential to manufacturing the final product.[18] While the United States can utilize its three major design producers Cadence, Synopsis, and Mentor to its advantage at the design state,[19] a few major manufacturing chokepoints exist. A semiconductor wafer fabrication chokepoint arises from Taiwan, specifically within Taiwan Semiconductor Manufacturing Company (TSMC).[20] TSMC produces 50 percent of the world’s semiconductors and over 90 percent of advanced nodes.[21] As the world becomes increasingly reliant on smaller, more advanced semiconductors, this is a critical chokepoint. Another critical actor at this stage is Samsung, in South Korea.[22] Samsung serves as a viable third-party manufacturing alternative.[23] As both manufacturing giants are in contingency zones where conflict with China or North Korea could occur, any conflict between these actors and the United States could compromise global supply of semiconductors. The interruption of semiconductor manufacturing does not impact every industry equally. However, as the world becomes increasingly dependent on semiconductors to run everything from computers to weaponry, examining the influence of chokepoints on manufacturing becomes increasingly critical as it might increasingly impact American security.

The United States has allowed for these critical chokepoints to occur at the manufacturing stage due to the cost of production. It has focused on its comparative advantage in design by exporting the manufacturing of semiconductors to countries where the know-how is available, and the costs are significantly lower. In the past, allowing for globalization of the semiconductor process has not been an issue because there have not been threats to US security. However, the world is shifting away from interdependence and towards great power competition.[24] Specifically, as China advances its semiconductor industry, the United States is forced to look inwards to see the necessity of returning some of these exported processes back to US soil. The White House echoed this urgency to return to domestic manufacturing of semiconductors on April 6, 2022, calling for $52 billion for subsidizing chip production.[25] While steps were made in June 2021 for increased chip manufacturing, this funding has not yet come to fruition.

While the global semiconductor supply chain is mostly dominated by the United States and its allies currently,[26] the United States has tried to gain the upper hand in the ongoing US-China technology conflict by pressuring TSMC to terminate their shipments of cutting-edge semiconductors to Chinese companies, going so far as to issue a foreign direct product rule designed to stop shipments of advanced semiconductors to Huawei’s HiSilcon chip subsidiary from TSMC on the same day when TSMC announced its new Arizona facility.[27] However, this action has only increased Chinese determination to focus on internal investment. China recognizes that South Korea and Taiwan are critical chokepoints in the supply chain, with Samsung and TSMC having the most wafer capacities out of all major foundries.[28] As such, US security planners should continue to focus on limiting these manufacturing chokepoints by turning inwards.

Looking Ahead for Both Countries

In the future, it will not come as a surprise if both countries decide to strengthen semiconductor capabilities in their respective domestic territories. Relying on a fragmented globalized supply chain presents inherent risks, as possible disruptions to any part of this chain can prove disastrous to the industry as a whole. The COVID-19 pandemic demonstrated how the negative impacts of an unexpected disruption to one part of the value chain affect the entire industry when the closure of many Chinese manufacturers hurts companies around the world, due to the central role that those manufacturers play in a myriad of supply chains and daily operations.[29] This is especially true as—unlike other technologies—the semiconductor industry slowed in growth, research, and development during the pandemic.[30] When accompanied with the closure of manufacturing plants, this exposed how vulnerable semiconductor capabilities are to changing geopolitical, economic, and social circumstances, especially when key systems reside abroad.

Boosting domestic semiconductor capabilities presents both countries with advantages and challenges. In the case of China, it is most likely going to continue utilizing governmental coordination and planning. In recent years, the Chinese government has created a series of policy responses to combat the country’s semiconductor problem, especially through state investment and ramping up a series of subsidies and novel mechanisms designed to introduce market forces into the industry and attract domestic and foreign investment.[31] Guiding documents and initiatives such as the National Integrated-Circuit Plan and Fund and “Made in China 2025” both identified government subsidies (taking the form of regional, provincial, national funds, investments vehicles, and broad incentivizing policies) as essential to China’s semiconductor industrial plan.[32] State investment follows clear guiding principles, and given the government’s close relationships with the private sector, it is also easy to identify power players within the field (the government directly communicates and partners with these players in an organized manner). Recent reports have shown, however, that the quantity of state-allocated capital has not been allocated efficiently and strategically, particularly at the subnational level.[33] Additionally, there is a lack of small and medium-sized enterprises (SMEs) compared to massive conglomerates and state-owned enterprises (which China has traditionally focused more on) that are able to absorb available funding.[34]

The United States, on the other hand, already possesses the necessary infrastructure to manufacture wafers to a certain degree.[35] Therefore, shifting semiconductor manufacturing back to domestic territory would not be as difficult of a task for the Americans, when compared to other actors. National security would also be further guaranteed, as “domestic design and manufacturing capabilities help reduce cybersecurity and espionage risks.”[36] With cyberattacks seeing a drastic increase in recent years, the United States can minimize risks and secure the domestic supply line by bringing manufacturing back. The United States has made progress on this front, passing the CHIPS Act that authorizes programs like the Multilateral Semiconductors Security Fund to bolster US fabrication capacity and support research and development of advanced chip capacity.[37] On the flip side, unlike China, the United States has a divide between state and private control over elements within the cybersecurity sector. While the private sector may be the best equipped to make innovative breakthroughs, it also faces complex trade-offs between innovation and security.[38] Private firms are driven by stakeholders and profit. This creates a dilemma between profit and protection; to innovate at a speed that is profitable requires security compromises, which create backdoors vulnerable to security risks. As the US government prioritizes closing security loopholes, it would need to take the reins on domestic semiconductor manufacturing to attain this end goal.

As the 2021 National Security Commission on Artificial Intelligence accurately pinpointed, we are now living in an AI era. Regardless of final policy decisions on semiconductor manufacturing, the two most prominent world powers and leaders in the field of AI—the US and China—need to be aware that their actions have global consequences. Implementing effective strategy over AI processes will require detailed thought into the threat environment of the future, especially as concerns over the future of Taiwan (and as a byproduct its technology industries) continue to boil in the wake of the Russo-Ukrainian war.

[1] Eric Schmidt and Bob Work, Final Report (Washington: National Security Commission on Artificial Intelligence, 2021), https://www.nscai.gov/wp-content/uploads/2021/03/Full-Report-Digital-1.pdf.

[2] Bo Julie Crowley and Raina Davis. Made in the USA: Revitalizing the Domestic Semiconductor Industry, (Harvard Kennedy School Belfer Center for Science and International Affairs, July 2020).

[3] Crowley and Davis, Made in the USA.

[4] Crowley and Davis, Made in the USA.

[5] Crowley and Davis, Made in the USA.

[6] Crowley and Davis, Made in the USA.

[7] Jan-Peter Kleinhas and Dr. Nurzat Baisakova, The Global Semiconductor Value Chain: A Technology Premier for Policy Makers, (Stiftung Neue Verantwortung, October 2020).

[8] Henry Farrell, “Clashing Information Orders Class Week 3” (class lecture, Johns Hopkins SAIS, Washington, DC).

[9] Henry Farrell, “Clashing Information Orders Class Week 3” (class lecture, Johns Hopkins SAIS, Washington, DC).

[10] Crowley and Davis, Made in the USA.

[11] Kleinhas and Baisakova, The Global Semiconductor Value Chain.

[12] John VerWey, “Chinese Semiconductor Industrial Policy: Prospects for Future Success,” Journal of International Commerce and Economics, (August 2019): 1–36, https://www.usitc.gov/publications/332/journals/chinese_semiconductor_industrial_policy_prospects_for_success_jice_aug_2019.pdf.

[13] VerWey, “Chinese Semiconductor Industrial Policy.”

[14] VerWey, “Chinese Semiconductor Industrial Policy.”

[15] VerWey, “Chinese Semiconductor Industrial Policy.”

[16] VerWey, “Chinese Semiconductor Industrial Policy.”

[17] Tian He, “When the chips are down: Biden’s semiconductor war,” The Lowy Institute, July 27, 2021, https://www.lowyinstitute.org/the-interpreter/when-chips-are-down-biden-s-semiconductor-war.

[18] He, “When the chips are down.”

[19] He, “When the chips are down.”

[20] Kleinhas and Baisakova, The Global Semiconductor Value Chain.

[21] Kleinhas and Baisakova, The Global Semiconductor Value Chain.

[22] Kleinhas and Baisakova, The Global Semiconductor Value Chain.

[23] Kleinhas and Baisakova, The Global Semiconductor Value Chain.

[24] Henry Farrell, “Clashing Information Orders Class Week 3” (class lecture, Johns Hopkins SAIS, Washington, DC).

[25] David Shepardson, “White House warns of ‘escalating vulnerabilities’ to U.S. from semiconductor shortage,” Reuters, April 6, 2022, https://www.reuters.com/world/us/white-house-warns-escalating-vulnerabilities-us-semiconductor-issue-2022-04-06/.

[26] Will Hunt, Saif M. Khan, and Dahlia Peterson, China’s Progress in Semiconductor Manufacturing Equipment: Accelerants and Policy Implications (Washington: Center for Security and Emerging Technology, 2021), https://cset.georgetown.edu/wp-content/uploads/CSET-Chinas-Progress-in-Semiconductor-Manufacturing-Equipment.pdf.

[27] Eurasia Group, The Geopolitics of Semiconductors (New York: Eurasia Group, 2020), https://www.eurasiagroup.net/files/upload/Geopolitics-Semiconductors.pdf.

[28] Kleinhas and Baisakova, The Global Semiconductor Value Chain.

[29] Willy Shih, “Is It Time to Rethink Globalized Supply Chains?,” MIT Sloan Management Review, March 19, 2020, https://sloanreview.mit.edu/article/is-it-time-to-rethink-globalized-supply-chains/.

[30] “Global Semiconductor Practice,” KPMG, last updated February 2017, https://home.kpmg/us/en/home/insights/2017/02/global-semiconductor-practice.html.

[31] Paul Triolo, “The Future of China’s Semiconductor Industry,” American Affairs V, no. 1 (Spring 2021): n.p., https://americanaffairsjournal.org/2021/02/the-future-of-chinas-semiconductor-industry/.

[32] VerWey, “Chinese Semiconductor Industrial Policy.”

[33] VerWey, “Chinese Semiconductor Industrial Policy.”

[34] Hunt, Khan, and Peterson, China’s Progress in Semiconductor Manufacturing Equipment.

[35] Crowley and Davis, Made in the USA.

[36] Crowley and Davis, Made in the USA.

[37] Gregory Arcuri, “The CHIPS for America Act: Why It is Necessary and What It Does,” Center for Strategic and International Studies, January 31, 2022, https://www.csis.org/blogs/perspectives-innovation/chips-america-act-why-it-necessary-and-what-it-does.

[38] Vinod K. Aggarwal and Andrew W. Reddie, “Comparative industrial policy and cybersecurity: the US case,” Journal of Cyber Policy 3, no. 3 (December 2018): 445–466, https://doi.org/10.1080/23738871.2018.1551910.